|  | |||||

Check the appropriate box: | ||

☐ | Preliminary Proxy Statement | |

☐ | CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2)) | |

☑ | Definitive Proxy Statement | |

☐ | Definitive Additional Materials | |

☐ | Soliciting Material ss.240.14a-12 | |

the appropriate box)all boxes that apply):

required.required

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. (1) Title of each class of securities to which transaction applies:(2) Aggregate number of securities to which transaction applies:(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11(set forth the amount on which the filing fee is calculated and state how it was determined):(4) Proposed maximum aggregate value of transaction:(5) Total fee paid:

materials.materials

Check box if any part of the fee is offset as providedRule 0-11(a)(2) Rules identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.(1) Amount Previously Paid:(2) Form, Schedule or Registration Statement No.:(3) Filing Party:(4) Date Filed:0-11

2024 Proxy Statement and Notice of Annual Meeting gm

Notice of 2024 Annual Meeting of Shareholders

WHO WE ARE AND WHY WE ARE HERE...April 24, 2024

Dear Shareholders:

Weearncustomers for life.

We build brands thatinspirepassion and loyalty.

We translatebreakthroughtechnologies into vehicles people love.

Weserveand improve the communities in which we live and work.

We are building themost valuedautomotive company.

Letter From the Chairman & Chief Executive Officer

Dear Fellow Shareholder:

I am pleased to inviteThe Board of Directors of General Motors Company invites you to attend our 2016the 2024 Annual Meeting of Shareholders.

Key to Our Success

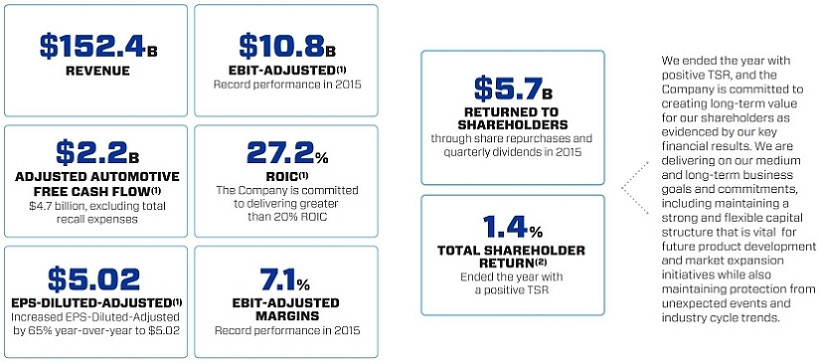

The key to our success is placing the customer at the center of everything we do, from safety and quality to design and connectivity. We strive to earn customers for life with brands that inspire passion and loyalty and with breakthrough technologies and experiences that people love. By satisfying our current customers and winning new ones on the strength of our latest cars, trucks and crossovers, we achieved solid financial results in 2015. This strong performance enabled us to reinvest in our business, including in the technology and advanced mobility solutions our customers expect and demand. Importantly, it also enabled us to increase shareholder returns through dividends and our expanded share repurchase program.

Strategic Plan

Our strategic plan, endorsed by the Board of Directors, is to continue strengthening our core business and to take advantage of this strength to define and lead the future of personal mobility. Around the world, social and technological changes are rapidly transforming personal transportation. I believe the automotive industry will change more in the next five years than it has in the previous 50 years. We’re excited by this kind of disruption and are working to lead it. To this end, we are leveraging our 1.2 billion OnStar customer interactions, we are leading the industry in 4G LTE connectivity, we launched Maven, our unified car-sharing program, we announced a strategic alliance with Lyft Inc., the fastest-growing ridesharing company in the U.S., and we have announced our intent to acquire Cruise Automation, Inc., a leader in autonomous technology. Later this year, we will launch the groundbreaking, all-electric Chevrolet Bolt EV, featured on the front cover of this Proxy Statement, and next year we will introduce “Super Cruise” hands-free highway driving automation technology in the 2017 Cadillac CT6.

Board Alignment

Our Board and leadership team are confident that our strategic plan will enable us to lead in the transformation of personal mobility. The Board fully supports our focus on optimizing long-term financial returns for our shareholders by increasing profitability in our core business, taking advantage of growth opportunities and driving innovation through this period of disruption and change.

The Board has the right mix of relevant expertise and experience to oversee and guide the leadership team as we execute our strategic plan. The Board’s diversity and independence foster the wide range of thought and perspective that is critical to the Company’s success. Establishing a best-in-class governance and compensation environment is a priority for the Board. We’ve highlighted our key accomplishments in governance for 2015 in the pages that follow.

Shareholder Outreach

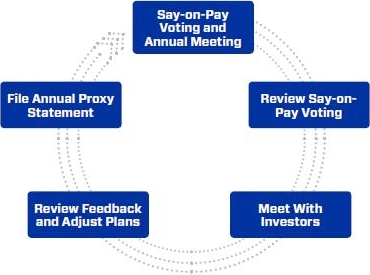

Over the past year, I have met with many of you through our expanded investor engagement program, which has enabled the GM leadership team and Board to meet and solicit feedback and share information with shareholders. Both GM and the Board benefit greatly from the insights, experiences and ideas exchanged during these engagements, and I look forward to continuing them in the year ahead.

Thank you for your support and interest in GM.

Sincerely,

|

|

Letter From the Independent Lead Director

Dear Fellow Shareholder:

General Motors Company is committed to sound corporate governance policies and practices that are designed and routinely assessed to enable the Company to operate its business responsibly, with integrity, and in the best interests of its shareholders. I want to take this opportunity to highlight the significant governance developments at GM over 2015 and early 2016. They are also described in more detail in this Proxy Statement.

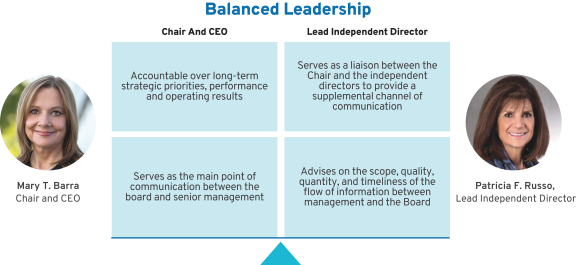

Board Leadership Structure

On January 4, 2016, our Board recombined the positions of Chairman and CEO under the leadership of Mary T. Barra and designated me as the Board’s Independent Lead Director. The Board concluded that it was in the best interests of the Company and its shareholders to combine the roles of Chairman and CEO at this time to drive the most efficient execution of our strategic plan and realize our vision for the future. At the same time, our Board strengthened the responsibilities of the Lead Director role, which are described in GM’s Corporate Governance Guidelines and in this Proxy Statement, to include additional duties that further promote independent, objective oversight by the non-employee directors. With these changes, the Board has adopted the right governance structure, with the right leaders and oversight, to drive shareholder value now and in the future.

Board Refreshment

The Board continues to recruit new directors to bring fresh perspectives and new ideas into the GM Boardroom. In 2015, we added two new directors: Linda R. Gooden, retired Executive Vice President, Information Systems & Global Solutions, Lockheed Martin Corporation, and Joseph Jimenez, CEO, Novartis AG. This year, we are pleased to announce the nomination of Jane L. Mendillo for election to the Board. Jane is the retired President and CEO of Harvard Management Company and brings a seasoned finance perspective and extensive investment management experience to our Board.

Shareholder Engagement and Proxy Access

To strengthen our commitment to receiving investor feedback, the Board has adopted a Director-Shareholder Engagement Policy that promotes proactive and productive engagement between directors and shareholders. Over the course of 2015 and through 2016, members of our Board have had and will continue to have direct conversations with investors on matters that are important to them, as well as matters on which GM wishes to share information or seek input.

In mid-2015, our Board began considering whether it would be appropriate to proactively adopt proxy access to provide our shareholders greater ability to have their voices heard through nomination of director candidates. Our process included a review of best practices, trends among other large public companies adopting proxy access and an extensive engagement process with shareholders. Reflective of our commitment to an active engagement process, the Board considered feedback from our shareholders and tailored certain aspects of the Company’s proxy access bylaw, which was adopted recently, based on that feedback.

Board Oversight

Board and Committee meetings regularly devote substantial time to GM’s strategic priorities, focusing on assessing the Company’s progress to date, as well as on strategic initiatives and risks over the short and long term. The Board believes that although short-term performance is important, it should be assessed in the context of the Company’s long-term goals.

As Lead Director, it is my privilege to work alongside engaged Board members who bring exceptional knowledge, perspective and commitment into the GM Boardroom. The robust debate around strategic priorities and initiatives that takes place at every Board meeting is evidence of the Board’s proactive oversight and guidance of management through this time of rapid industry change.

On behalf of the entire Board, thank you for your continued support.

Sincerely,

|

|

Notice of 2016Annual Meeting of Shareholders

April 22, 2016

Dear Fellow Shareholder:

You are cordially invited to attend the Annual Meeting, of Shareholders of General Motors Company. At the meeting you will be asked to:

| • | Elect the 12 Board-recommended director nominees named in this Proxy Statement; |

| • | Ratify the selection of |

| • | Approve, on an advisory basis, named executive officer compensation; | ||

| • | Vote on Rule 14a-8 shareholder proposals, if properly presented at the meeting; and |

| • | Transact any other business that is properly |

A list of the Company’s registered shareholders will be available for examination for any purpose that is germane to the meeting for ten business days before the Annual Meeting. Shareholders may request to review the list by emailing the Company at shareholder.relations@gm.com.

Record Date

You are entitledThis Proxy Statement is provided in conjunction with GM’s solicitation of proxies to votebe used at the meeting if you were a holder of record of GM common stock at the close of business on April 8, 2016.

AttendingAnnual Meeting. For additional information about how to attend our Annual Meeting, see “General Information About the Annual Meeting

If you plan to attend the Annual Meeting, please follow the instructionsMeeting” starting on page 73 of this Proxy Statement.87.

Webcast

Our Annual Meeting will be audio webcast on June 7, 2016 and may be accessed atwww.gm.com/gmannualmeeting. Additional information regarding the audio webcast may be found on page 73.

Thank you for your interestcontinued investment in GM.General Motors Company.

By Order of the Board of Directors,

| Craig Glidden Corporate Secretary 300 Renaissance Center Detroit, Michigan 48265 |

Meeting Information | ||||||

Date: June 4, 2024 Time: 11:00 a.m. Eastern Time | ||||||

Place:Online via live webcast at: virtualshareholdermeeting.com/GM2024 Record Date: April 15, 2024 | ||||||

Your Vote Is Important | ||||||

Your vote is important.So that your shares will be represented and voted at the meeting, please submit your vote as soon as possible by one of the following methods:

| ||||

Please promptly submit your vote by internet or telephone, or by signing, dating, and returning the | ||||

| ||||

| ||||

| ||||

We are first mailing these proxy materials to our shareholders on or about April 24, 2024. |

We are first furnishing these proxy materials to our shareholders on or about April 22, 2016.

How

Important Notice Regarding the Availability of Proxy Materials for the

Our Proxy Statement and 2023 Annual Report

| ||||||

| 2024 Proxy Statement | i |

To Our Fellow Shareholders,

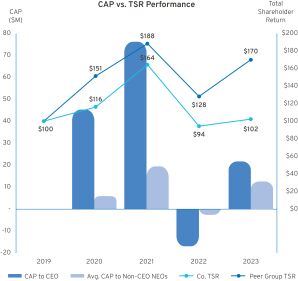

2023 Performance Fueling 2024 Execution

As 2024 progresses, the Board believes GM is well-positioned for a year of strong financial and operational performance that will build on everything the Company accomplished – and learned – in 2023. Last year, we succeeded in optimizing our core business to continue investing in our future. In addition to growing our revenue by approximately 10 percent year-over-over, we reported net income attributable to stockholders of $10.1 billion and EBIT-adjusted of $12.4 billion, which marked the third consecutive year of reaching or exceeding our financial targets. According to J.D. Power, GM led the industry in initial quality for the second year in a row, so it is no surprise that we also led the industry in U.S. sales, and all our U.S. brands grew their sales year-over-year. We gained U.S. market share while maintaining healthy margins thanks to stable pricing and incentive discipline. We also generated very strong free cash flow, which is allowing us to return significant capital to shareholders, including through the $10.0 billion accelerated share repurchase program we announced in November 2023, and through additional share repurchases and an increased quarterly dividend rate this year.

As GM makes progress on its path of fundamental transformation, we continue to refine our plan. We learned a lot from the challenges of 2023, and those learnings are helping us build on our strengths, address our issues, and make the necessary changes to create an even stronger GM. Our priorities and commitments for 2024 and beyond are clear: We plan to maximize the opportunities we have with our winning ICE portfolio, grow our EV business profitably, deliver innovative software and services solutions, and continue progressing AV technology and relaunching AV operations through Cruise – all while driving strong financial performance and maintaining our commitments to safety, culture, and a leading customer experience. We are well-positioned for success in 2024 with refreshed ICE launches, including the next-generation Chevrolet Traverse and Equinox and GMC Acadia, higher production of Ultium EVs like the Cadillac LYRIQ, GMC HUMMER EV, and Chevrolet Blazer EV, and new EV launches, including the Chevrolet Equinox EV and Silverado EV RST, GMC Sierra EV Denali, and Cadillac Escalade IQ, all of which are arriving in showrooms this year.

Driving Accountability

With these priorities in mind, the Compensation Committee made several key enhancements to our compensation plans for 2024 that we believe will drive execution and hold management accountable for performance against specific, near-term strategic goals aligned with the four strategic pillars identified above. Moving forward, short-term incentive compensation for eligible employees will depend both upon financial performance and the Company’s ability to achieve certain goals mapped to these pillars. At the same time, we are evolving our long-term incentive programs to more closely align compensation with total shareholder returns. Together, these enhancements will drive near-term execution, long-term shareholder value, and help attract and retain key talent. For a full description of these enhancements, please see Compensation Committee Chair Wes Bush’s letter to shareholders and the Compensation Discussion and Analysis beginning on page 42.

| ii |  |

Accelerating a Winning Team Over the past few years, we have made a number of important moves that will help the Company execute its strategic plan, manage succession, and create shareholder value. They include enhancing the blend of relevant skills and experience on the Board with new directors Joanne Crevoiserat, Jon McNeill, Mark Tatum, and Jan Tighe. As we continue this work, Aneel Bhusri will not stand for re-election at the Annual |  | |||

This page intentionally left blank.

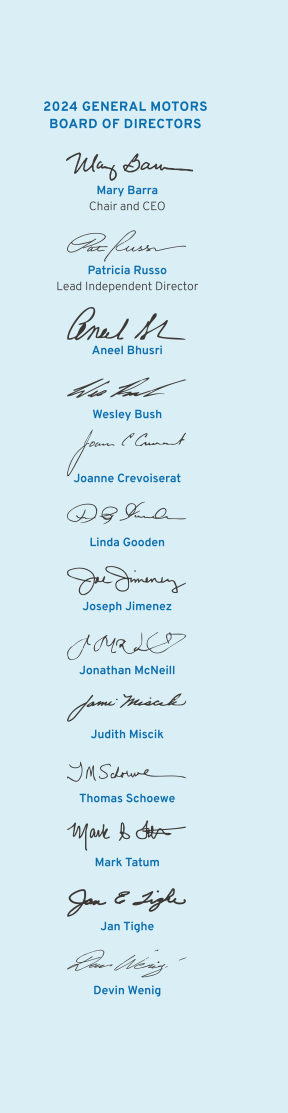

In addition to changes to Board Composition, we have made changes to our senior leadership team to support the Company’s continued transformation and growth. We have promoted internal leaders following purposeful professional development and injected the team with fresh perspectives from complex, global companies and technology leaders like Apple, Google, and CVS Health, among others. These new leaders have broadened our perspectives and shifted the team closer to our customer composition, while making us more willing to ask the tough questions, quicker to solve the hard problems, and better positioned to compete smarter. Providing for continuity of leadership at the senior management level is among the most important things we do on the Board. It is critical to the Company’s success, and the Board will continue to place a high priority on robust talent development and attraction. For details regarding our Board refreshment and succession planning, see page 17, and for details regarding our CEO and senior management succession planning, see page 31. Annual Meeting Preview At the Annual Meeting, we will provide an update on the Company’s transformation and performance, vote on several items related to our business, and shareholders will have the opportunity to ask questions. We encourage you to review this Proxy Statement Sincerely, Your 2024 GM Board of Directors |

|

| 2024 Proxy Statement | iii |

Table of Contents

Cautionary Note on Forward-Looking Statements:This Proxy Statement may include “forward-looking statements” within the meaning of the U.S. federal securities laws. Forward-looking statements are any statements other than statements of historical fact. Forward-looking statements represent our current judgement about possible future events. In making these statements, we rely upon assumptions and analysis based on our experience and perception of historical trends, current conditions, and expected future developments, as well as other factors we consider appropriate under the circumstances. We believe these judgements are reasonable, but these statements are not guarantees of any future events or financial results, and our actual results may differ materially due to a variety of factors, many of which are described in our 2023 Form 10-K and our other filings with the SEC. We caution readers not to place undue reliance on forward-looking statements. Forward-looking statements speak only as of the date they are made, and we undertake no obligation to update publicly or otherwise revise any forward-looking statements, whether as a result of new information, future events, or other factors that affect the subject of these statements, except where we are expressly required to do so by law. Non-GAAP financial measures:See our 2023 Form 10-K and our other filings with the SEC for a description of certain non-GAAP measures used in this Proxy Statement, along with a description of various uses for such measures. Our calculation of these non-GAAP measures are set forth within these reports and Appendix A to this Proxy Statement, and may not be comparable to similarly titled measures of other companies due to potential differences between companies in the method of calculation. As a result, the use of these non-GAAP measures has limitations and should not be considered superior to, in isolation from, or as a substitute for, related GAAP measures. When we present our total company EBIT-adjusted, GM Financial is presented on an EBT-adjusted basis. Additional Information: References to “record” or “best” performance (or similar statements) in this Proxy Statement refer to General Motors Company, as established in 2009. In addition, certain figures included in the charts and tables in this Proxy Statement may not sum due to rounding. Simulated models and pre-production models are shown throughout; production vehicles will vary. For information on models shown, including availability, see each GM brand website for details. |

| iv |  |

Proxy Summary

Annual Meeting Overview

TIME & DATE |

PLACE |

RECORD DATE |

MATERIALS | |||

11:00 a.m. Eastern Time June 4, 2024 | Virtual Meeting virtualshareholdermeeting.com/GM2024 | April 15, 2024 | Available at investor.gm.com/shareholder |

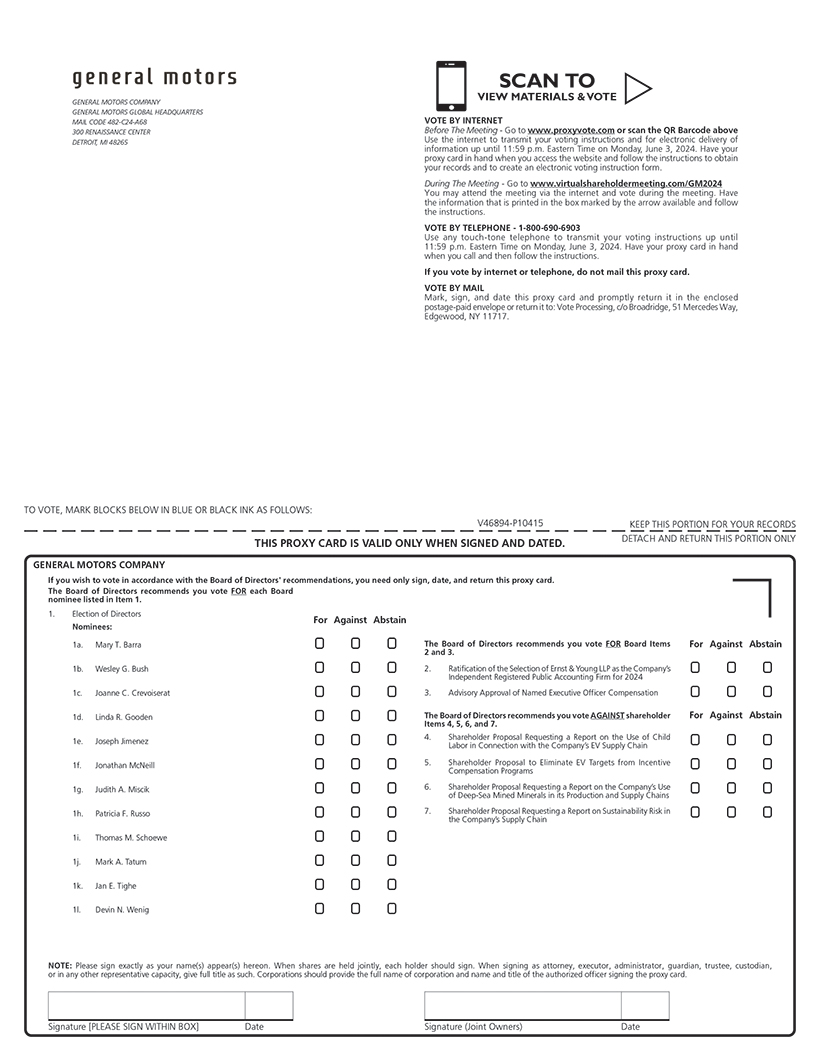

Proxy Voting Roadmap

Shareholders will be asked to vote on the following matters at the Annual Meeting:

Voting Matter | Board Vote Recommendation | Page Reference | ||||

Item 1: | Annual Election of Directors | FOR each director nominee | 9 | |||

Item 2: | Proposal to Ratify the Selection of Ernst & Young LLP as the Company’s Independent Registered Public Accounting Firm | |||||

| 2024 | FOR | 38 | ||||

Item 3: | Proposal to Approve, on an Advisory Basis, Named Executive Officer Compensation | FOR | 41 | |||

Item 4: | ||||||

AGAINST | 79 | |||||

Item 5: | Shareholder Proposal to Eliminate EV Targets from Incentive Compensation Programs | AGAINST | 81 | |||

Item 6: | Shareholder | AGAINST | 83 | |||

Item 7: | Shareholder Proposal Requesting a Report on Sustainability Risk in the Company’s Supply Chain | AGAINST | 85 | |||

| PROXY SUMMARY | 2024 Proxy Statement | 1 |

Snapshot of Your 2024 Board Nominees

Name | Principal Occupation | Age | Director Since | Independent | Committee Memberships | |||||

Mary T. Barra |

Chair and Chief Executive Officer, General Motors Company |

62 |

2014 |

|

- Executive (Chair) | |||||

Wesley G. Bush |

Retired Chairman and Chief Executive Officer, Northrop Grumman Corporation |

63 |

2019 |

✓ | - Audit - Compensation (Chair) - Executive - Finance | |||||

Joanne C. Crevoiserat |

Chief Executive Officer, Tapestry, Inc. |

60 |

2022 |

✓ |

- Audit - Finance - Governance | |||||

Linda R. Gooden |

Retired Executive Vice President, Information Systems and Global Solutions, Lockheed Martin Corporation |

71 |

2015 |

✓ | - Audit - Executive - Risk and Cybersecurity (Chair) | |||||

Joseph Jimenez |

Co-Founder and Managing Director, Aditum Bio |

64 |

2015 |

✓ |

- Compensation - Executive - Finance (Chair) - Risk and Cybersecurity | |||||

Jonathan McNeill |

Co-Founder and Chief Executive Officer, DVx Ventures |

56 |

2022 |

✓ |

- Governance | |||||

Judith A. Miscik |

Senior Advisor, Lazard Geopolitical Advisory |

65 |

2018 |

✓ |

- Finance - Risk and Cybersecurity | |||||

Patricia F. Russo |

Chair, Hewlett Packard Enterprise Company |

71 |

2009 |

✓ | - Compensation - Executive - Finance - Governance (Chair) | |||||

Thomas M. Schoewe |

Retired Executive Vice President and Chief Financial Officer, Wal-Mart Stores, Inc. |

71 |

2011 |

✓ |

- Audit (Chair) - Executive - Finance - Risk and Cybersecurity | |||||

Mark A. Tatum |

Deputy Commissioner and Chief Operating Officer, National Basketball Association |

54 |

2021 |

✓ |

- Audit - Governance | |||||

Jan E. Tighe |

Retired Vice Admiral, U.S. Navy |

61 |

2023 |

✓ |

- Audit - Risk and Cybersecurity | |||||

Devin N. Wenig |

Co-Founder and Chief Executive Officer, Symbolic.ai |

57 |

2018 |

✓ |

- Compensation | |||||

| 2 |  | PROXY SUMMARY |

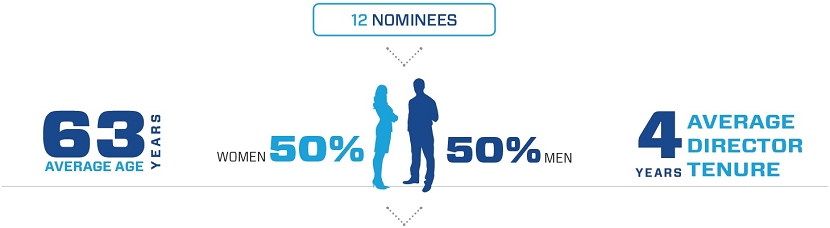

Proxy Statement Summary2024 Board Nominee Statistics

General Motors is committed to ensuring its Board remains a strategic asset to the Company and that it is comprised of diverse directors across race, ethnicity, gender, and age, among other factors. We have also thoughtfully managed director succession planning to leverage the combined benefits of deep institutional knowledge and new perspectives through Board refreshment.

| 50% | 67% | 6.3 | 62.9 | |||

| Women | Board Committee Chairs of Gender or Racial/Ethnic Diversity | Years Average Tenure | Years Average Age | |||

Strong and Independent Board Leadership

The Board benefits from strong and independent leadership and maintains the flexibility to decide when the positions of Chair and CEO should be combined or whether an independent director should serve as Chair. This flexibility allows the Board to choose the leadership structure that it believes will best serve the interests of our shareholders at any particular time based on a number of considerations, including the strategic direction of the Company and the needs of the Board and its committees.

Currently, the Board has determined that it is in the Company’s best interest to combine the roles of CEO and Chair with Mary Barra and elected Patricia Russo as the Independent Lead Director. Ms. Russo brings decades of corporate governance experience and deep knowledge of the Company to the role, ensuring the Board is led with a strong, independent voice. For more information on our Board leadership structure and the duties and responsibilities of our Independent Lead Director, see the section titled “Board Leadership Structure” on page 22.

This summary highlights information contained elsewhere in this Proxy Statement. It does not contain all of the information that you should consider. Please read the entire Proxy Statement carefully before voting.

| PROXY SUMMARY | 2024 Proxy Statement | 3 |

Voting Recommendations

2023 Business Highlights

Financial Highlights

| Board | |||

| Proposals: | Recommendation | Page | |

| 1. | Election of directors | FOR ALL | 9 |

| 2. | Approve, on an advisory basis, NEO compensation | FOR | 63 |

| 3. | Ratification of the selection of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for 2016 | FOR | 64 |

| 4. | Shareholder proposal regarding Implementation of Holy Land Principles for Employment in Palestine-Israel | AGAINST | 67 |

| $10.1B | 5.9% | $7.32 | ||

Net income attributable to stockholders | Net income margin | EPS-diluted | ||

| $12.4B | 7.2% | $7.68 | ||

| EBIT-adjusted(1) | EBIT-adjusted(1) margin | EPS-diluted-adjusted(1) | ||

| $171.8B | $20.8B | $11.6B | ||

| Revenue | Automotive operating cash flow | Returned to shareholders via dividends and share repurchases(2) | ||

| Non-GAAP financial measure. Refer to Appendix A for a reconciliation of |  | ||

|  | |||

|  | |||

|  | |||

|  | |||

|  | |||

|  | |||

|  | |||

|  | |||

| ||||

| their closest comparable GAAP measure. |

| (2) | Including the impact of our $10.0 billion accelerated share repurchase program, which is expected to be completed no later than Q4 2024. |

Performance Highlights

U.S. Market Leader #1 in total sales #1 in total trucks #1 in full-size SUVs #1 Affordable small SUVs #1 Commercial fleet deliveries |

Earned #1 ranking on J.D. Power Initial Quality Study for the second consecutive year | Announced a $10.0B accelerated share repurchase program and a 33% increase in our quarterly dividend starting in 2024 | ||||||

Total company revenue grew ~10% year-over-year, with U.S. market share up ~0.3 percentage points | ||||||||

EBIT-adjusted(1) of $12.4B, the third consecutive year reaching or exceeding our financial target |

Sold more than 1 million crossovers in the U.S. in 2023 |

| 4 |  | PROXY SUMMARY |

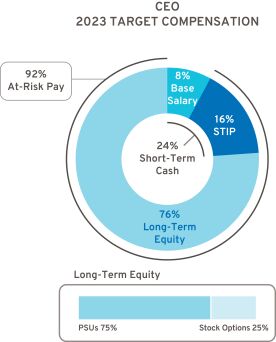

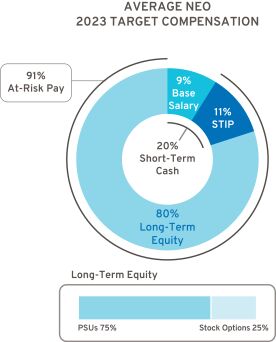

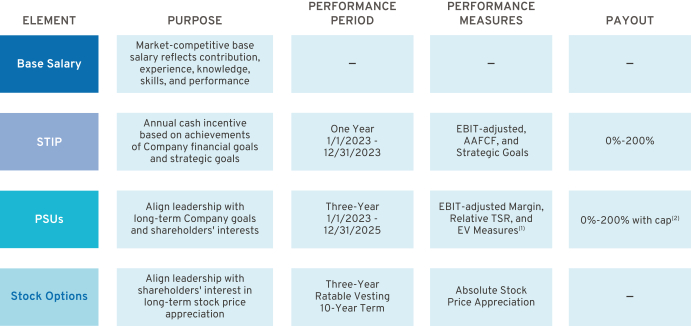

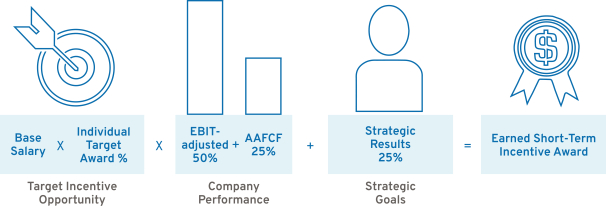

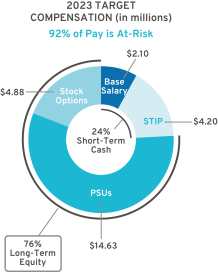

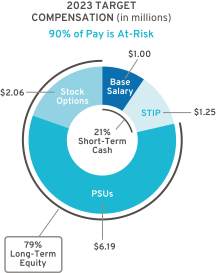

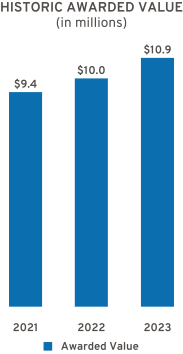

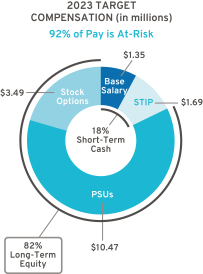

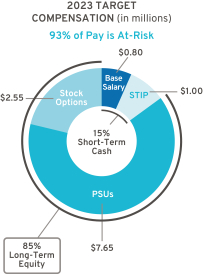

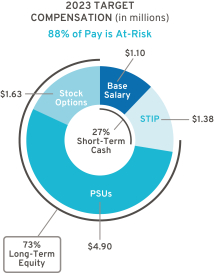

Compensation Highlights

Our executive compensation program is designed to focus our leaders on key areas that drive the business forward, align to the short-term and long-term interests of our shareholders, and reward our leaders for delivering on the Company’s strategy and vision.

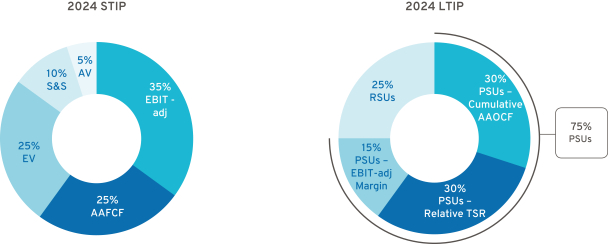

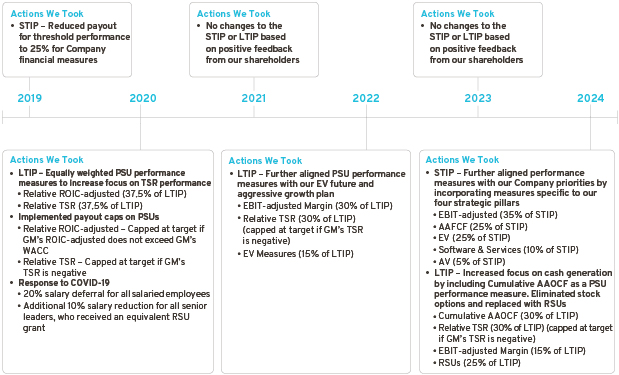

2024 STIP and LTIP Design Changes

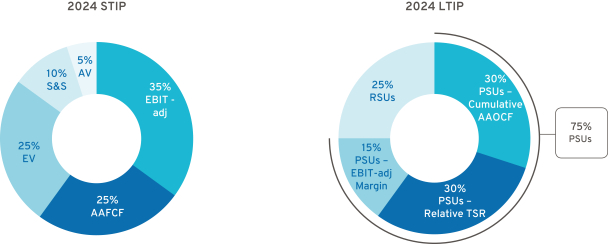

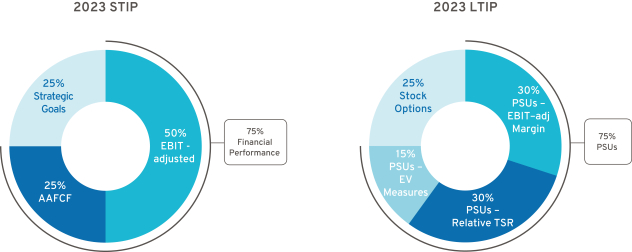

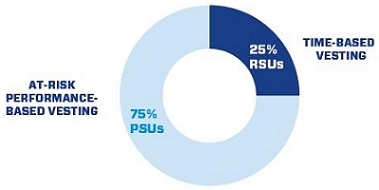

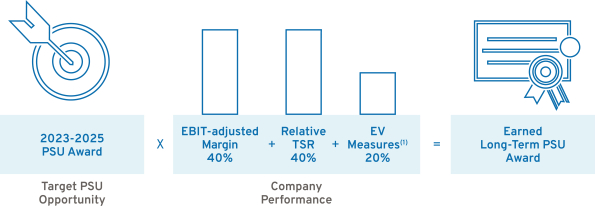

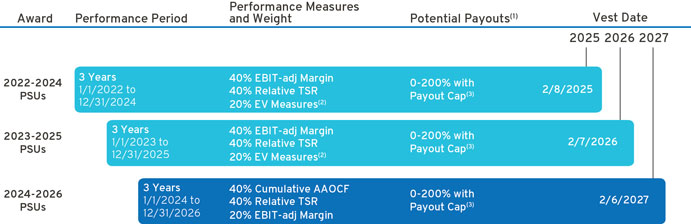

As discussed in the Board’s letter to shareholders at the beginning of this Proxy Statement, we have enhanced our STIP and LTIP beginning with the 2024 performance year following an extensive review by the Compensation Committee, with the objective of strengthening the alignment of our plans with our evolving financial and strategic goals. The Board’s Nominees for Director2024 STIP performance measures will continue to include EBIT-adjusted (35% of STIP) and AAFCF (25% of STIP) as the primary financial measures to align with the performance of our ICE portfolio. In addition, the STIP will now incorporate EV (25% of STIP), Software & Services (“S&S”) (10% of STIP), and AV (5% of STIP) performance measures that align to the strategic pillars of our business. The 2024 LTIP structure will continue to include PSUs (75% of LTIP), and will now incorporate RSUs (25% of LTIP) in lieu of stock options to improve our ability to attract and retain critical talent and to more efficiently use the shares available in the equity plan. The 2024 LTIP PSU performance measures will include Cumulative AAOCF (30% of LTIP), EBIT-adjusted Margin (15% of LTIP), and Relative TSR (30% of LTIP). The redesigned LTIP continues to focus on driving shareholder value and Company profitability, while increasing the focus on cash generation during this critical period of transformation.

The Board recommends a voteFORthe election of each of the following nominees for director:

| Director | Committee | Skills and | |||||||||

| Name | Age(1) | Since | Independent | Membership(2) | Qualifications | ||||||

| Mary T. Barra Chairman & Chief Executive Officer, General Motors Company | 54 | 2014 | EC (Chair) |  | ||||||

| Theodore M. Solso Independent Lead Director, General Motors Company, and Retired Chairman and Chief Executive Officer, Cummins, Inc. | 69 | 2012 |  | EC |  | |||||

| Joseph J. Ashton Retired Vice President, United Auto Workers | 67 | 2014 | FC, RC |  | ||||||

| Linda R. Gooden Retired Executive Vice President, Information Systems & Global Solutions, Lockheed Martin Corporation | 63 | 2015 |  | AC, RC |  | |||||

| Joseph Jimenez Chief Executive Officer, Novartis AG | 56 | 2015 |  | ECC, GCRC |  | |||||

| Kathryn V. Marinello Senior Advisor, Ares Management LLC | 59 | 2009 |  | AC, GCRC, FC |  | |||||

| Jane L. Mendillo Retired President and Chief Executive Officer, Harvard Management Company | 57 | — |  | — |  | |||||

| Admiral Michael G. Mullen Former Chairman, Joint Chiefs of Staff | 69 | 2013 |  | AC, EC, RC (Chair) |  | |||||

| James J. Mulva Retired Chairman and Chief Executive Officer, ConocoPhillips | 69 | 2012 |  | EC, ECC, FC (Chair), RC |  | |||||

| Patricia F. Russo Chairman, Hewlett Packard Enterprise Company | 63 | 2009 |  | EC, ECC, FC, GCRC (Chair) |  | |||||

| Thomas M. Schoewe Retired Executive Vice President and Chief Financial Officer, Wal-Mart Stores, Inc. | 63 | 2011 |  | AC (Chair), EC, FC, RC |  | |||||

| Carol M. Stephenson Retired Dean, Ivey Business School, The University of Western Ontario | 65 | 2009 |  | EC, ECC (Chair), GCRC |  |

| PROXY SUMMARY | 2024 Proxy Statement | 5 | ||||||||||

|  |  |  |  |  |  |  |  | ||||

Stewardship Engagement

“I regularly meet with investors to share the Board’s perspective on the Company’s strategic direction and discuss the skills needed on the Board to oversee the Company’s transformation. This year, I was pleased to be joined by Wes Bush, who shared steps the Board’s Executive Compensation Committee has taken to further align our executive compensation philosophy to the Company’s evolving strategy. Wes and I shared outcomes from these discussions with our Board colleagues and the feedback received has helped shape our disclosures.”

– Patricia F. Russo, Independent Lead Director

The Company’s extensive stewardship outreach program engages with institutional investors and other stakeholders to help the Board and management gain feedback on a variety of topics and intentionally seeks input from different perspectives. The feedback received from these sessions is communicated to the Governance Committee and Compensation Committee throughout the year. In 2023, members of our Board or management team conducted over 50 such stewardship engagements, including with shareholders representing over 30 percent of our common stock. In addition to those sessions, we participate in a number of activities throughout the year that provide the opportunity to communicate our strategy to shareholders and listen to a diverse set of opinions. A sample of such activity in 2023 included:

HOW TO CONTACT OUR BOARD

Shareholders and interested parties wishing to contact our Board may send a letter to GM’s Corporate Secretary at General Motors Company, Mail Code 482-C24-A68, 300 Renaissance Center, Detroit, Michigan 48265 or by email at shareholder.relations@gm.com. Communications received in writing will be distributed to the Independent Lead Director or independent members of reasonable the Board as a group, if appropriate, unless such communications are considered, in the reasonable judgment of the Corporate Secretary, improper for submission to the intended recipient(s).

| 6 |  | PROXY SUMMARY |

The table below provides a summary of common themes we have recently heard that led to boardroom discussion and action:

Message |  | ||

Requested to further explain how GM’s compensation strategy incentivizes the executive leadership team. | For a discussion of the actions taken to further evolve the Company’s executive compensation program, see page 42. | ||

Encouraged to further accelerate the return of capital to shareholders pursuant to the Company’s Capital Allocation Framework. | In Q4 2023, the Board announced a $10 billion accelerated share repurchase program and announced its intention to increase the common stock dividend by 33% beginning in Q1 2024. | ||

Inquired about the Board’s role in overseeing risks related to the Company’s talent pipeline and succession plans. | The Board has been forward leaning in assisting management in the recruitment of talent as it transitions key skill sets required to manage the Company well into the future. For a discussion of the actions taken to further disclose the Board’s oversight of talent and succession planning, see page 31. | ||

Encouraged to continue the Company’s transparent reporting practices related to sustainability initiatives, including on climate change, human rights, and supply chain governance. | We published the Company’s third Sustainability Advocacy Report, which discloses the Company’s advocacy efforts on climate change policy, fleet emissions, fuel economy regulations, and policies to support the automotive industry’s transition to EVs. Last year, we also conducted the Company’s first Human Rights Symposium, which facilitated opportunities for various thought-leaders in the space to share perspectives and led to the Company hosting its first Indigenous Rights Workshop. The Company also joined the First Movers Coalition through commitments to low-carbon concrete, cement, aluminum and steel, signaling a firm market demand for a net-zero transition and our dedication to a more resilient and sustainable supply chain. | ||

Requested to disclose the Board’s oversight of cybersecurity risks. | Last year, the Board added Vice Admiral Tighe to further its cybersecurity expertise as the Company scales its EV deployment. For a detailed description of recent activities completed by the Board’s Risk and Cybersecurity Committee, see page 26 and for a description of cybersecurity risk oversight, see page 29. | ||

| PROXY SUMMARY | 2024 Proxy Statement | 7 |

Governance and Sustainability

This page intentionally left blank.Governance Highlights

ITEM NO. 1 – ELECTION OF DIRECTORSThe Board is committed to governance structures and practices that protect shareholder value and important shareholder rights. The Governance Committee regularly reviews these structures and practices and makes updates as appropriate. Highlights of GM’s governance structures include the following:

Director Election Requirements

OurAdditional Sustainability and Governance Resources

Shareholders can access the additional sustainability and governance resources listed below at investor.gm.com/governanceandsustainability.

Charters and Governance Documents: | Political Disclosures: | |

Board Committee Charters | 2023 Sustainability Advocacy Report | |

Bylaws and Certificate of Incorporation | U.S. Political Engagement Overview, Priorities, and Trade Association Disclosures | |

Corporate Governance Guidelines | ||

| Voluntary Report of 2021 Political Contributions | ||

Compliance Documents: | Sustainability: | |

Company Policy on Corporate Political Contributions and Expenditures | Anti-Harassment Policy Environmental Policy Human Rights Policy Responsible Minerals Sourcing Policy Supplier Code of Conduct Sustainability Framework Sustainability Report | |

Global Integrity Policy | ||

GM’s Code of Conduct: “Winning with Integrity” | ||

Insider Trading Policy | ||

Policy on Recoupment of Incentive Compensation | ||

Related Party Transactions Policy | ||

For more information regarding GM’s environmental and social initiatives, please see our other voluntary sustainability disclosures, available at investor.gm.com/governanceandsustainability. |

| 8 |  | PROXY SUMMARY |

ITEM NO. 1:

Annual Election Of Directors

At the Annual Meeting, 12 directors will be nominated for election to GM’s Board is elected annually byof Directors. The Governance Committee evaluated the nominees in accordance with the Committee’s charter and our shareholders. UponCorporate Governance Guidelines and submitted the recommendationnominees to the Board for approval.

The Board believes that the director nominees’ diverse backgrounds, attributes, and experiences provide valuable insights for the Board’s oversight of the Governance and Corporate Responsibility Committee (“Governance Committee”), our Board has nominated eachCompany. Eight of the 12 persons identified belownominees, or 67 percent, bring gender, racial, or ethnic diversity to the Board, including four of the six committee chairs.

Of the 12 director nominees, all were previously elected at the 2023 annual meeting. Further information on the Board’s composition, as well as each nominee’s qualifications and relevant experience, are provided on the following pages.

If elected, the director nominees will serve as director for a one-year termon the Board until the next annual meeting of shareholders, or until his or her successor has beentheir successors are duly elected and qualified, or until his or hertheir earlier resignation or removal. Each director nominee who receives a majority of the votes cast (i.e., the number of shares voted FOR a director nominee must exceed the number of shares voted AGAINST that director nominee, excluding abstentions) will be elected as director in this uncontested election. If any nominee becomes unable to serve, proxies will be voted for the election of such other person as the Board of Directors may designate, unless the Board chooses to reduce the number of directors.directors standing for election. Each of the nominees has consented to being named in this Proxy Statement and serving on the Board, if elected.

Stephen J. Girsky has elected to retire from the Board effective as of the Annual Meeting and is not standing for re-election.

| The Board recommends a vote FOR each of the nominees identified | |

| ITEM NO. 1: ANNUAL ELECTION OF DIRECTORS | 2024 Proxy Statement | 9 |

Other than Jane L. Mendillo, all directors were elected at the 2015 Annual Meeting.

Board Experience and Expertise

Skills Matrix

The Board’s nomination of Ms. Mendillo followed completion of our standard candidate evaluation procedures, which include identification and evaluation of potential candidates by a search firm engagedskills matrix below summarizes certain qualifications used by the Governance Committee candidate interviews by a subcommitteein their evaluation of the Governance Committee, and interviews with other members of the Board.our director nominees.

|  |  |  |  |  |  |  |  |  |  |  | |||||||||||||||

| Public Company CEO | ● | ● | ● | ● | ● | ● | |||||||||||||||||||

| Industry | ● | ● | |||||||||||||||||||||||

| Manufacturing | ● | ● | ● | ● | ● | ● | ● | ● | |||||||||||||||||

| Technology | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||||||||

| Risk Management | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | |||||||||||||

| Finance | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | |||||||||||||||

| Marketing | ● | ● | ● | ● | ● | ● | ● | ||||||||||||||||||

| Cyber | ● | ● | ● | ● | ● | ||||||||||||||||||||

| ESG | SG | ESG | ESG | SG | EG | ESG | SG | SG | ESG | SG | SG | SG | |||||||||||||

To supplement the skills matrix, since 2021, the Board has also undertaken an annual ESG self-evaluation. The evaluation is designed to ensure that the Board possesses the requisite skills and expertise to oversee the Company’s ESG opportunities, priorities, and enterprise risks. The Governance Committee is responsible for recommending nomineesleads this effort by asking directors to consider their expertise across key ESG subject matter areas identified in the skills key above. Upon the conclusion of the annual evaluation, the Board annually. In determining whether to recommenddetermined that it has strong ESG expertise and possesses a director for re-election,broad range of skills, qualifications, and attributes that will support the Governance Committee considers a number of factors, including the director’s history of attendance and participation in meetings, other contributions to the activitiesCompany’s sustainability strategy. Results of the Board and GM, active participation in orientation and ongoing educational events,Board’s ESG self-evaluation are represented on the results of Board self-evaluations and any potential or actual conflicts of interest.skills matrix above.

Skills Key

The Board nominates directors upon the recommendation of the Governance Committee. The Governance Committee annually reviews with the Board the appropriate skills and characteristics needed for the Board to effectively perform its oversight function. Board nominees are then selected, whether existing or new, after considering current Board composition, Company strategy and other relevant facts and circumstances.

Public Company CEO | Experience over an extended period, especially as CEO; extraordinary leadership qualities; and the ability to identify and develop those qualities in others. | |

Industry | Expertise in key businesses and proven knowledge of key customers and risks associated with the automotive industry. | |

Manufacturing | Experience in, or experience in a senior management position responsible for, significant manufacturing operations. | |

Technology | Expertise in, or understanding of technology and innovation gained either though academia or industry experience. | |

Risk Management | Relevant experience in risk management and oversight. | |

Finance | Expertise in complex financial and/or accounting matters to evaluate financial statements, capital structure and allocation, business plans, and qualify as audit committee financial experts. | |

Marketing | Expertise regarding brand maintenance and expansion, product awareness, customer engagement, digital marketing, and/or social media experience. | |

Cyber | Experience managing cybersecurity security risks or understanding the cybersecurity threat landscape which helps provide valuable knowledge, guidance, and oversight of the Company’s cybersecurity risks. | |

Environmental | Expertise with environmental matters, including GHG emissions; raw material sources; waste and hazardous materials management; product design and lifecycle management; water and wastewater management; and/or energy efficiency management. | |

Social | Expertise with DE&I; data privacy; human rights; community relations; workplace health and safety; supply chain management; human capital management; consumer privacy; product quality and safety; and/or labor practices. | |

Governance | Experience with public company board governance; legal and regulatory matters; executive compensation; compliance and business ethics; anti-competitive practices; risk management; and/or ESG reporting principles and frameworks. | |

| 10 |  | ITEM NO. 1: ANNUAL ELECTION OF DIRECTORS |

Director Nominee Biographies

Chair and CEO, General Motors Company

Age: 62 Director since: 2014 Gender: Female Race/Ethnicity: White Committees: Executive (Chair) Favorite GM Vehicle: GMC Hummer EV Pickup | Mary T. Barra Experience: Ms. Barra is Chair and CEO of General Motors. She has served as Chair of the Board of Directors since January 2016 and has served as CEO since January 2014. Prior to becoming CEO, Ms. Barra served as GM’s Executive Vice President, Global Product Development, Purchasing and Supply Chain from 2013 to 2014; Senior Vice President, Global Product Development from 2011 to 2013; Vice President, Global Human Resources from 2009 to 2011; and Vice President, Global Manufacturing Engineering from 2008 to 2009. Ms. Barra began her career with GM in 1980. Reasons for Nomination: Ms. Barra has in-depth knowledge of the Company and the global automotive industry; extensive senior leadership, strategic planning, operational, and business experience; and a strong engineering background with experience in global product development. She has spearheaded many initiatives to align the Company’s culture with its transformation efforts and holds herself and the leadership team accountable for driving a culture of safety for customers, employees, and communities. Other Public Company Directorships: The Walt Disney Company Prior Public Company Directorships (2019-2024): None | |||||||

Skillset |

| |||||||

Q: | What actions is the Company taking to increase shareholder value? | |||||||

| A: | Building on what we learned last year, 2024 will be a year focused on our four strategic pillars as laid out in the Board’s letter to shareholders at the beginning of this Proxy Statement. I believe our execution will drive strong near-term financial results and long-term shareholder value while executing against our capital allocation framework by investing smartly in our future, maintaining a strong balance sheet, and continuing to return capital to shareholders. | |||||||

Chair, Hewlett Packard Enterprise Company Age: 71 Director since: 2009 Gender: Female Race/Ethnicity: White Committees: Compensation Executive Finance Governance (Chair) Favorite GM Vehicle: Cadillac Lyriq | Patricia F. Russo |  Independent Independent | ||||||||

Experience: Ms. Russo has served as the Chair of the Hewlett-Packard Enterprise Company’s (“HPE”) board of directors since her appointment in 2015. She also served as Lead Director of HPE from 2014 to 2015. Ms. Russo was GM’s Independent Lead Director from March 2010 to January 2014, and in 2021, she was re-appointed to that role. Ms. Russo served as CEO of Alcatel-Lucent S.A. from 2006 to 2008; Chairman and CEO of Lucent Technologies, Inc. from 2003 to 2006; and President and CEO of Lucent Technologies from 2002 to 2006. Reasons for Nomination: Ms. Russo has extensive senior leadership experience in corporate strategy, finance, sales and marketing, technology, and leadership development, as well as experience managing business-critical technology disruptions. Through her deep governance expertise – in particular, board governance – she works with management to develop enhanced disclosures and incorporate shareholder feedback. Other Public Company Directorships: Hewlett Packard Enterprise Company (Chair), KKR Management LLC, and Merck & Co. Inc. Prior Public Company Directorships (2019-2024): None | ||||||||||

Skillset |

| |||||||||

Q: | GM has added three new directors since 2022, what does the Board look for in its searches? | |||||||||

| A: | More diverse perspectives in the boardroom leads to more robust dialogue and drives better decisions. The Governance Committee has been focused on building the right mix of skills and perspectives on things like industry disruption, technology, artificial intelligence, and global competition. The key is to make sure our director recruitment criteria evolve alongside the business strategy and responds to market challenges. | |||||||||

| ITEM NO. 1: ANNUAL ELECTION OF DIRECTORS | 2024 Proxy Statement | 11 |

Retired Chairman and CEO, Northrop Grumman Corporation Age: 63 Director since: 2019 Gender: Male Race/Ethnicity: White Committees: Audit Compensation (Chair) Executive Finance Favorite GM Vehicle: Chevrolet Silverado | Wesley G. Bush |  Independent Independent | ||||||||

Experience: Mr. Bush served as Chairman of Northrop Grumman’s board of directors from 2011 to 2019. He also served as the CEO of Northrop Grumman from 2010 to 2018. Prior to that, Mr. Bush served in numerous leadership roles at Northrop Grumman, including President and Chief Operating Officer, CFO, and President of the company’s Space Technology sector. He also served in a variety of leadership positions at TRW, Inc., before it was acquired by Northrop Grumman in 2002. Reasons for Nomination: Mr. Bush has valuable experience in leading a manufacturing enterprise known for its advanced engineering and technology. He also has strong financial acumen gained through his finance leadership roles and has knowledge of key governance issues, including risk management and executive compensation plan design. Mr. Bush has also developed environmental experience as a member of the board of Conservation International. Other Public Company Directorships: Dow Inc. and Cisco Systems Inc. Prior Public Company Directorships (2019-2024): Norfolk Southern Corporation and Northrop Grumman Corporation | ||||||||||

Skillset |

| |||||||||

Q: | How has the Board helped management attract new executive talent? | |||||||||

| A: | When designing our executive compensation plans, the Board balances the need to develop existing executive bench strength with a recognition that fresh external perspectives can help support the Company’s transformation efforts. We believe the enhancements to GM’s short term and long-term compensations plans (described further in the CD&A starting on page 42 of this proxy statement) will help the Company offer attractive compensation plans to attract and retain the best talent in the world, and aligning that talent on executing our strategy. | |||||||||

CEO, Tapestry, Inc. Age: 60 Director since: 2022 Gender: Female Race/Ethnicity: White Committees: Audit Finance Governance Favorite GM Vehicle: Cadillac Escalade | Joanne C. Crevoiserat |  Independent Independent | ||||||||

Experience: Since October 2020, Ms. Crevoiserat has been CEO and a member of the board of Tapestry, Inc. Prior to her appointment as interim CEO in July 2020, she served as the CFO. She also previously served in senior roles at Abercrombie & Fitch Co., Kohl’s Inc., Wal-Mart Stores, Inc., and May Department Stores. Reasons for Nomination: Ms. Crevoiserat has cultivated an extensive background in financial expertise and brand development. Her leadership capabilities demonstrated through her various senior leadership retail positions help the Company as it grows its global consumer brands through consumer-centric, digital, and data-driven initiatives. Ms. Crevoiserat also has social and environmental proficiency which she has gained through her experience in the retail industry and which allows her to provide unique oversight of supply chain governance and sustainable material sourcing. Other Public Company Directorships: Tapestry, Inc. Prior Public Company Directorships (2019-2024): At Home Group Inc. | ||||||||||

Skillset |

| |||||||||

Q: | What have you learned about the auto industry since joining the Board? | |||||||||

| A: | There are many similarities between the automotive industry and the clothes, accessory, and lifestyle brand space where I have spent most of my career. I’ve enjoyed the opportunity to be part of a Board that can help the Company pursue data-driven strategies to forge strong customer connections as it works to deepen the relationship between its customers and its historically strong brands during the transition to EVs and the adoption of other new technologies. | |||||||||

| 12 |  | ITEM NO. 1: ANNUAL ELECTION OF DIRECTORS |

Retired Executive Vice President, Information Systems and Global Solutions, Lockheed Martin Corporation Age: 71 Director since: 2015 Gender: Female Race/Ethnicity: African American Committees: Audit Executive Risk and Cybersecurity (Chair) Favorite GM Vehicle: Cadillac CT5 | Linda R. Gooden |  Independent Independent | ||||||||

Experience: Ms. Gooden served as Executive Vice President, Information Systems and Global Solutions of Lockheed Martin Corporation from 2007 to 2013. She also served as Lockheed Martin’s Deputy Executive Vice President, Information and Technology Services from October to December 2006, and as its President, Information Technology from 1997 to December 2006. Reasons for Nomination: Ms. Gooden has strong leadership capabilities demonstrated through her various senior leadership positions at Lockheed Martin. She also has significant expertise in operations and strategic planning, as well as an extensive background in information technology and cybersecurity. Ms. Gooden serves as an effective advocate through the development of innovative software and oversight of software-defined transportation. Other Public Company Directorships: NeueHealth, Inc. (formerly Bright Health Group Inc.) Prior Public Company Directorships (2019-2024): The Home Depot, Inc. and Automatic Data Processing, Inc. | ||||||||||

Skillset |

| |||||||||

Q: | What do you think is a key emerging risk for the Company? | |||||||||

| A: | My career in the aerospace and the defense industries has helped me deeply appreciate the risks posed by new technologies. As Chair of the Risk and Cybersecurity Committee, I’ve helped the Board assess the key risks and opportunities posed by new key technologies. Recently, I’ve helped drive focus on artificial intelligence, which has the potential to provide companies with huge operational efficiencies, but also presents risks like enabling competitors and the need to comply with complex regulations emerging around the globe. | |||||||||

Co-Founder and Managing Director, Aditum Bio Age: 64 Director since: 2015 Gender: Male Race/Ethnicity: Hispanic Committees: Compensation Executive Finance (Chair) Risk and Cybersecurity Favorite GM Model: GMC Hummer EV SUV | Joseph Jimenez |  Independent Independent | ||||||||

Experience: Since 2019, Mr. Jimenez has served as Co-Founder and Managing Partner of Aditum Bio, a biotechnology-focused venture capital firm. Prior to that, he served as CEO of Novartis AG from 2010 until his retirement in 2018. Mr. Jimenez led Novartis’ Pharmaceuticals Division from October 2007 to 2010 and its Consumer Health Division in 2007. From 2006 to 2007, he served as Advisor to the Blackstone Group L.P. Mr. Jimenez was also Executive Vice President, President, and CEO of Heinz Europe from 2002 to 2006; and President and CEO of H.J. Heinz Company North America from 1999 to 2002. Reasons for Nomination: Mr. Jimenez has served as the CEO of a global company with significant research and development and capital spending in a highly regulated environment. He also has significant experience in finance, strategic planning, and consumer branding and marketing. Other Public Company Directorships: The Procter & Gamble Co. and Century Therapeutics, Inc. Prior Public Company Directorships (2019-2024): Graphite Bio, Inc. | ||||||||||

Skillset |

| |||||||||

Q: | How does the Finance Committee help shape the Company’s Capital Expenditure strategy? | |||||||||

| A: | We regularly review GM’s key vehicle programs to ensure they continue to yield strong financial returns. We also oversee the Company’s Capital Allocation Framework to make sure we are delivering on our commitment to return excess cash to shareholders after we make smart investments in our business and balance sheet. This work led to the Company’s recent $10 billion accelerated share repurchase program. | |||||||||

| ITEM NO. 1: ANNUAL ELECTION OF DIRECTORS | 2024 Proxy Statement | 13 |

Co-Founder and CEO, DVx Ventures Age: 56 Director since: 2022 Gender: Male Race/Ethnicity: White Committees: Governance Favorite GM Model: Chevrolet Silverado EV | Jonathan McNeill |  Independent Independent | ||||||||

Experience: Since 2020, Mr. McNeill has served as CEO of DVx Ventures, a venture company focused on early-stage startups. Prior to founding DVx Ventures, he served as Chief Operating Officer of Lyft, Inc. from 2018 to 2019. From 2015 to 2018, he also served as President, global sales, delivery and service of Tesla, Inc., and led the team growing revenues from $2 billion to over $20 billion annually across 33 countries. In addition, in 2023, Mr. McNeill was appointed as Vice Chair of the Cruise Board. Reasons for Nomination: Mr. McNeill has deep experience as both an entrepreneur and as an executive at companies of significant scale. He is a demonstrated leader in the EV space with expertise in business models, software architecture, and cyber. Through his experience in positions of senior leadership, he has founded and scaled multiple technology and retail companies. In addition Mr. McNeill has GHG emissions, air quality, and product design and lifecycle management experience, which he has gained through driving EV adoption. Other Public Company Directorships: Lululemon Athletica Prior Public Company Directorships (2019-2024): None | ||||||||||

Skillset |

| |||||||||

Q: | What do you think is the most important opportunity for GM? | |||||||||

| A: | GM is positioned to lead in autonomous and software-defined vehicles. The Board is supporting these efforts by working closely with Cruise, GM’s AV subsidiary, where I serve as the Vice Chair of its board. The GM Board has deep experience scaling new technologies, start-ups, and we have shared it with the Cruise team as it works to enhance transparency and community engagement and rebuild trust with regulators. | |||||||||

Senior Advisor, Lazard Geopolitical Advisory Age: 65 Director since: 2018 Gender: Female Race/Ethnicity: White Committees: Finance Risk and Cybersecurity Favorite GM Model: Chevrolet Blazer EV | Judith A. Miscik |  Independent Independent | ||||||||

Experience: Ms. Miscik is a Senior Advisor at Lazard Geopolitical Advisory. Previous to her current role, she served as CEO and Vice Chairman of Kissinger Associates, Inc. from 2017 to 2022 and before that in other senior leadership positions. Prior to joining Kissinger Associates, Ms. Miscik was the Global Head of Sovereign Risk at Lehman Brothers from 2005 to 2008; and from 2002 to 2005, she served as Deputy Director for Intelligence at the U.S. Central Intelligence Agency, where she worked from 1983 to 2005. Reasons for Nomination: Ms. Miscik has a unique and extensive background in intelligence, security, government affairs, and risk analysis, bringing valuable experience in assessing and mitigating geopolitical and macroeconomic risks in both the public and the private sectors. Other Public Company Directorships: Morgan Stanley and HP, Inc. Prior Public Company Directorships (2019-2024): None | ||||||||||

Skillset |

| |||||||||

Q: | How does the Board stay current with respect to the geopolitical risks faced by the company? | |||||||||

| A: | The Board’s Risk and Cybersecurity Committee regularly reviews management’s risk dashboards and annually reviews its enterprise risk profile, which includes geopolitical issues. Last year, the Board also received a briefing from the National Counterintelligence and Security Center focused on risks in international markets related to insider threats, cyber activities, and supply chain disruptions. This session generated important Board dialogue on the complex geopolitical dynamics in global supply chains. | |||||||||

| 14 |  | ITEM NO. 1: ANNUAL ELECTION OF DIRECTORS |

Retired Executive Vice President and CFO, Wal-Mart Stores, Inc. Age: 71 Director since: 2011 Gender: Male Race/Ethnicity: White Committees: Audit (Chair) Executive Finance Risk and Cybersecurity Favorite GM Model: Cadillac Lyriq | Thomas M. Schoewe |  Independent Independent | ||||||||

Experience: Mr. Schoewe served as Executive Vice President and CFO of Wal-Mart Stores, Inc. from 2000 to 2011. Prior to joining Wal-Mart, he held several senior roles at the Black & Decker Corporation, including CFO from 1993 to 1999. Before joining Black & Decker, Mr. Schoewe worked for Beatrice Companies where he was CFO and Controller of one of its subsidiaries, Beatrice Consumer Durables Inc. Reasons for Nomination: Mr. Schoewe has extensive financial experience acquired through positions held as the CFO of large public companies, as well as expertise in internal controls, risk management, and mergers and acquisitions. He also has significant international experience through his service as an executive of large public companies with substantial international operations and large-scale transformational installations of global enterprise information technologies. Mr. Schoewe leverages his service on the Audit Committee Leadership Network to advise on the implementation of rigorous controls around sustainability disclosures and compliance with new regulations. Other Public Company Directorships: Northrop Grumman Corporation Prior Public Company Directorships (2019-2024): KKR Management LLC | ||||||||||

Skillset |

| |||||||||

Q: | How can the Board enhance the customer experience? | |||||||||

| A: | During my time at Walmart, I learned that you need to focus on the human element to earn customers for life. With that in mind, the Board is a “customer advocate.” The Company is increasingly competing with upstart EV companies that are leveraging the flexibility of their direct-to-consumer sales models. We have provided our expertise to help management develop strategies to enhance the effectiveness of GM’s dealer network and use digital tools to drive retail sales. | |||||||||

Deputy Commissioner and Chief Operating Officer, National Basketball Association Age: 54 Director since: 2021 Gender: Male Race/Ethnicity: Black, Asian Committees: Audit Governance Favorite GM Model: Cadillac Escalade IQ | Mark A. Tatum |  Independent Independent | ||||||||

Experience: Mr. Tatum joined the National Basketball Association (NBA) in 1999 and was appointed NBA Deputy Commissioner and Chief Operating Officer in 2014. Prior to that, he served in numerous leadership roles at the NBA, including Executive Vice President of Global Marketing Partnerships, Senior Vice President and Vice President of Business Development, Senior Director and Group Manager of Marketing Properties, and Director of Marketing Partnerships. Reasons for Nomination: Mr. Tatum has extensive senior leadership experience in marketing and sales strategy, managing media relationships, and global business operations. He also has significant experience driving customer engagement and operations globally through his leadership roles at the NBA. Other Public Company Directorships: None Prior Public Company Directorships (2019-2024): None | ||||||||||

Skillset |

| |||||||||

Q: | How is the Board influencing the Company’s DEI strategy? | |||||||||

| A: | An effective DEI strategy drives a company’s performance by attracting and retaining great talent and building positive connections with customers and the communities where companies operate. The Company has made great progress on DEI, and the Board works closely with the Company’s Chief People Officer to share its insights and helps GM prepare for and manage various DEI headwinds and engage effectively with its workforce. | |||||||||

| ITEM NO. 1: ANNUAL ELECTION OF DIRECTORS | 2024 Proxy Statement | 15 |

Retired Vice Admiral U.S. Navy Age: 61 Director since: 2023 Gender: Female Race/Ethnicity: White Committees: Audit Risk and Cybersecurity Favorite GM Model: Chevrolet Corvette | Jan E. Tighe |  Independent Independent | ||||||||

Experience: Vice Admiral Tighe retired from the U.S. Navy in 2018, having served as the Deputy Chief of Naval Operations for Information Warfare and Director of Naval Intelligence. Her prior Flag Officer assignments include command of the Navy’s Fleet Cyber Command, President of the Naval Postgraduate School, and Deputy Director of Operations at U.S. Cyber Command. Reasons for Nomination: Vice Admiral Tighe cultivated her operational experience in complex cybersecurity matters, including operational technologies, information systems technology, technology risk management, and strategic assessments, while serving in global operations roles for the U.S. Navy and the National Security Agency. Her more than 20 years of senior military leadership experience during a critical period of transformation in the U.S. Navy also provides critical human capital insights as the Company transforms its workforce to deploy its EV and AV technologies. Other Public Company Directorships: The Goldman Sachs Group, Inc. and Huntsman Corporation Prior Public Company Directorships (2019-2024): The Progressive Corporation and IronNet Inc. | ||||||||||

Skillset | | |||||||||

Q: | How did the new director orientation enhance your understanding of the Company? | |||||||||

| A: | During my GM director orientation last year, I had the opportunity to visit the Flint Assembly Manufacturing Plant and the Detroit Hamtramck Factory Zero Assembly Center. Walking the floor and engaging with the workforce provided great insight into GM’s advanced manufacturing capabilities. At the Flint plant, I also met with the Company’s veterans’ group and the UAW Local 598 Veterans Committee, who support veteran programs in the area. I left impressed by the impact GM has on the local communities where it operates. These experiences helped lay a strong foundation for my understanding of the Company. | |||||||||

Co-Founder and CEO, Symbolic.ai Age: 57 Director since: 2018 Gender: Male Race/Ethnicity: White Committees: Compensation Favorite GM Model: Chevrolet Silverado EV | Devin N. Wenig |  Independent Independent | ||||||||

Experience: Since 2023, Mr. Wenig has served as Co-Founder and CEO of Symbolic.ai, a platform and application with advanced AI capabilities for publishers and professional writers in news, research, and communications. Previously, he served as President and CEO of eBay Inc. and as a member of its board of directors from July 2015 to August 2019. Mr. Wenig also served as President of eBay’s Marketplaces business from September 2011 to July 2015. Prior to joining eBay, Mr. Wenig was CEO of Thomson Reuters Corporation’s largest division, Thomson Reuters Markets, from 2008 to 2011; Chief Operating Officer of Reuters Group plc from 2006 to 2008; and President of Reuters’ business divisions from 2003 to 2006. Reasons for Nomination: Mr. Wenig has extensive senior leadership experience in software and technology, global operations, and strategic planning. He also has significant expertise leading both high-growth companies from the start-up phase and large, complex organizations. Other Public Company Directorships: None Prior Public Company Directorships (2019-2024): eBay Inc. | ||||||||||

Skillset |

| |||||||||

Q: | Can you discuss how the Company’s software capabilities have evolved during your time on the Board? | |||||||||

| A: | I’ve watched the Company evolve its software capabilities in everything the customer touches, both in the vehicle and through other digital interfaces like Shop.Click.Drive. I’m confident GM’s future in software will continue to grow and enhance the customer experience. Software can drive important advancements in safety, driver assistance, and autonomous technologies – not to mention future software-defined vehicle capabilities. | |||||||||

| 16 |  | ITEM NO. 1: ANNUAL ELECTION OF DIRECTORS |

Board Membership Criteria, Refreshment, and Succession Planning

The selection of qualified directors is complexfundamental to the Board’s successful oversight of GM’s strategy and crucial to ourenterprise risks. We seek directors who bring diverse viewpoints and perspectives, possess a variety of skills, professional experiences, and backgrounds, and effectively represent the long-term success.interests of shareholders. The Governance Committee and the Board set different priorities for recruiting new Board members at different times, dependingdirectors are continually evolving based on the Company’s needsstrategic needs. It is important that the Board remains a strategic asset capable of overseeing and helping management address the makeuprisks, trends, and opportunities GM is facing now and in the future.

In evaluating potential director candidates, the Governance Committee considers, among other factors, the criteria included on the skills matrix on page 10, the skills and experience of our current directors, and certain additional characteristics that it believes one or more directors of the Board.Board should possess based on an assessment of the needs of the Board at that time. In every case, however,director candidates for Board election must be able to contribute significantly to the Board’s discussion and decision-making on the broad array of complex issues facing the Company.GM. The Governance Committee sometimesalso engages a reputable, qualified search firmsfirm to help identify and evaluate potential candidates. Recently, our recruiting efforts have been particularly directed toward identifying candidates who have distinguished themselves as leaders of large, complex organizationsIn addition, GM’s Corporate Governance Guidelines include the general policy that non-employee directors will not stand for election after reaching age 72, with strong expertise in technology, strategy, finance,any exceptions requiring approval by the Board. At this time, the Board has not approved any exceptions and global investment management.each Board candidate is compliant with the Corporate Governance Guidelines.

| ||||

Potential candidates meeting these priorities are further evaluated on criteria that include:

| |

| |

| |

| |

| |

| |

| |

| |

|

In assessing potential candidates,2023, the Governance Committee considersreviewed its Board succession plan and five-year roadmap on a quarterly basis to ensure the Board holds the relevant and necessary talent to serve the Company and its shareholders. The Governance Committee believes its succession planning and assessment will allow it to continue important recruitment efforts and identify new skill sets required as the Company’s strategy evolves. As a result of this work, the Board has elected seven new members over the past five years, including Ms. Crevoiserat and Mr. McNeill in 2022 and Vice Admiral Tighe in 2023. The Governance Committee made these nominations by employing the process described below in the “Director Recruitment Process” section of this Proxy Statement and considering, among other factors, shareholders’ interest in Board refreshment, preserving the Board’s strong diversity, and adding directors with experience in technology, industry, marketing, and cybersecurity. The Board believes its new directors will help ensure a seamless transition over the next several years as some directors retire in due course, as well as bolster its expertise as GM continues to execute against its four key strategic pillars.

Board Diversity

The Company’s Corporate Governance Guidelines identify the Board’s commitment to seeking highly qualified candidates that reflect the diverse backgrounds of GM’s global workforce and customer base, thereby ensuring women and individuals with a broad range of business experience and varied backgrounds. Although GM does not have a formal policy governing diversity amongfrom minority groups are included in the pool from which Board members, we continually strive to add directors of diverse backgrounds. We recognizenominees are selected. Our Board recognizes the value of overall diversity and considerconsiders members’ and candidates’ opinions, perspectives, personal and professional experiences, and backgrounds, including gender, race, ethnicity, nationality, and country of origin, when considering Board candidates.sexual orientation. We believe that the judgment and perspectives offered by a diverse board of directorsBoard improves the quality of decision-making and enhances the Company’s business performance. We also believe suchSuch diversity can help the Board respond more effectively to the needs of customers, shareholders, employees, suppliers, and other stakeholders worldwide.stakeholders.

Candidate Recommendations

Pursuant to the Stockholders Agreement dated October 15, 2009 between the Company and the UAW Retiree Medical Benefits Trust (the “VEBA Trust”), the VEBA Trust has the right to designate one nominee to our Board, subject to the consent of the UAW and approval by the Board (the Board may not withhold its approval unreasonably). The VEBA Trust has designated Mr. Ashton, who has been recommended by the Governance Committee and nominated by the Board as part of the slate of candidates it recommends for election at the Annual Meeting.

The Governance Committee will consider personsdirector candidates recommended by shareholders for election to the Board. To recommend an individual for Board membership, write to Jill E. Sutton, Corporate Secretary and Deputy General Counsel, Corporate, Finance and Strategic Transactions (“Corporate Secretary and Deputy General Counsel”) of our Company, at the mailing address or e-mail address provided on page 74 in“How can I obtain the Company’s corporate governance information?”shareholders. The Governance Committee will review the qualifications and experience of each recommended candidate using the same criteria for candidates proposed by Board members and communicate its decision to the candidate or the personshareholder who made the recommendation.

GM has received notice pursuant to our Bylaws that a shareholder owning two shares of our common stock intends to nominate candidates for election Shareholder nominations must be submitted to the Board at the 2016 Annual Meeting. The Board has determined in its reasonable judgment that this is not considered a contested election, and therefore, majority voting will apply. The Governance Committee evaluated these candidates as discussed above, and the Proxy Committee appointedCompany by the Board intends to vote against the election of these candidates.deadlines found on page 90.

TO RECOMMEND A DIRECTOR CANDIDATE, WRITE TO: GM’s Corporate Secretary at General Motors Company, Mail Code 482-C24-A68, 300 Renaissance Center, Detroit, Michigan 48265 or by email to shareholder.relations@gm.com. |

| ITEM NO. 1: ANNUAL ELECTION OF DIRECTORS |  | |||||||||

| 17 |

Director

Your Board recommends a voteFORall of the nominees listed below. Recruitment Process

| ||||

Set forth below is information about our nominees, including their name and age, recent employment or principal occupation, their period of service as a GM director, the names of other public companies for which they currently serve as a director or have served as a director within the past five years, and a summary of their specific experience, qualifications, attributes, and skills that led to the conclusion that they are qualified to serve as a director on our Board at this time.

|

Ms. Barra was elected Chairman of the GM Board of Directors on January 4, 2016. She has served as CEO of GM since January 15, 2014, when she also became a member of GM’s Board. Prior to becoming CEO, Ms. Barra served as Executive Vice President, Global Product Development, Purchasing and Supply Chain since August 2013. She served as Senior Vice President, Global Product Development, from 2011 to 2013; Vice President, Global Human Resources, from 2009 to 2011; and Vice President, Global Manufacturing Engineering, from 2008 to 2009.

Reasons for Nomination:

With more than 35 years at GM and having served in various leadership roles prior to becoming Chairman and CEO of the Company, Ms. Barra brings to our Board an in-depth knowledge of the Company and the global automotive industry. She has extensive leadership, strategic planning, operating and business experience and a deep understanding of the Company’s strengths, weaknesses, risks, and challenges. Under her leadership, GM is working to lead the transformation of personal mobility through advanced technologies such as connectivity, alternative propulsion, and autonomous driving. She has also established GM’s corporate culture and strategic direction based on putting the customer at the center of everything we do, all around the world, with quality and safety as foundational commitments.

As Chairman and CEO, Ms. Barra is able to focus the Board’s oversight and drive the most efficient execution of GM’s plan and vision for the future. In addition to her demonstrated leadership and management skills, Ms. Barra’s strong engineering background and leadership experience in global product development enables her to provide significant insight to the Board on one of the most critical and complex parts of GM’s business. Her previous leadership roles in purchasing and supply chain, human resources, and manufacturing engineering also allow her to contribute to Board deliberations on matters regarding those key areas of the Company. Ms. Barra’s service to GM and experience in serving as a director of another large public company with complex, global operations provides her with an extensive understanding of the governance and management matters that large public companies face.

| |

Mr. Solso has served as the Independent Lead Director of our Board since January 4, 2016. Mr. Solso had been the Non-Executive Chairman of our Board of Directors since January 2014. He served as Chairman and Chief Executive Officer of Cummins, Inc., a global manufacturer of diesel and natural gas engines and engine-related component products, from 2000 until his retirement in 2011. Prior to becoming Chairman and CEO, Mr. Solso held various other senior management roles, including President and Chief Operating Officer from 1995 through 1999 and Vice President in charge of Cummins’ engine business from 1988 to 1995.

Reasons for Nomination: